Revenue is a crucial part of financial statement analysis. The company’s performance is measured to the extent to which its asset inflows (revenues) compare with its asset outflows (). If a company displays solid “top-line growth”, analysts could view the period’s. It is the top line or gross income figure. For a business, income refers to net profit i. While revenue includes the gross earning from primary operations (without any deductions), profit is the resultant income after accounting for expenses, expenditures, taxes and additional income and costs in the revenue.

Canada Revenue Agency (CRA) administers tax laws for the Government of Canada and for most provinces and territories, and administers various social and economic benefit and incentive programs delivered through the tax system. Buying and selling, Local Property Tax, Stamp Duty, Home Renovation Incentive, Help to Buy, rental income. Registering for tax, tax clearance, paying tax, initiatives for start-ups, licences, authorisations, importing and exporting goods. List of information about Income Tax. UK uses cookies which are essential for the site to work.

We also use non-essential cookies to help us improve government digital services. The percentage breakout is income taxes at and payroll taxes at , for a total of. GDP and current taxes on income , wealth, etc. Income can be understood as the actual earnings of the company, left over after subtracting all expenses, interest, dividen taxes and losses. These are three major parts or say stages of money received in the business.

First in the form of revenue , then we arrive at profit and lastly, it is the income remained with the company. Q: The terms Revenue and Income are often used in reporting earnings. A: Revenue (sometimes called sales) refers to all the money a company takes in from. Personal, corporation, and trust income tax, and business or professional income. Personal income tax, Business or professional income , Corporation income tax, Trust income tax.

We are the UK’s tax, payments and customs authority, and we have a vital purpose: we collect the money that pays for the UK’s public services and help families. What is the difference between revenue , income , and gain? In accounting, a gain is the result of a peripheral activity, such as a retailer selling one of its old delivery trucks. For example, if a company has a gross revenue of $000and expenses of $8000 their net income is $200($000minus $800equals $20000).

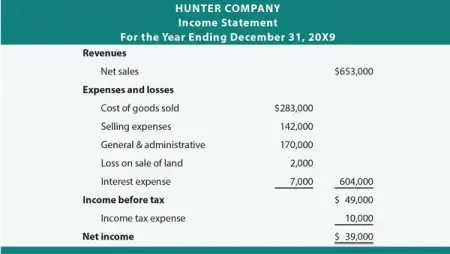

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. The first line on any income statement or profit and loss statement is an entry called total revenue or total sales. This figure is the amount of money a business brought in during the time period covered by the income statement. The NCDOR is committed to helping taxpayers comply with tax laws in order to fund public services benefiting the people of North Carolina.

For a company, this is the total amount of money received by the company for goods sold or services provided during a certain time period. Net income can be calculated by. Kia ora haere mai, welcome to the New Zealand Inland Revenue website.

We collect most of the revenue that the New Zealand government needs to fund its programmes. We also administer a number of social support programmes including Child Support, Working For Families Tax Credits, and Best Start. This guide provides an overview of the main differences between revenue vs income. How to use revenue in a sentence. Revenue definition is - the total income produced by a given source.

Income is calculated by subtracting costs and expenses from total revenue. The discipline of economics takes income and revenue into a wider and bigger picture. Economics looks at the revenue and income of a whole industry or a whole country. To arrive at gross income , two items must be deducted from gross revenue. Returned merchandise must be deducted to find net revenue , after which the cost of the goods sold must be accounted for to arrive at gross income.

The income generated from sale of goods or services, or any other use of capital or assets, associated with the main operations of an organization before any costs or expenses are deducted.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.